Today, a pledge with delivery represents an excellent level of security for a creditor in the event of a company defaulting on payment.

If you want to obtain new financing, this is a very attractive solution. You can use your stocks as collateral for your creditors.

In this article, you will find the definition of a pledge with delivery, its advantages and we will highlight the steps involved in setting up this type of arrangement.

When a company pledges one of its assets, it is using it to secure a debt. It retains full ownership of the asset until the loan becomes due and payable.

Pledging with dispossession is a form of guarantee that makes it possible to secure a debt by adding a right of retention to the simple pledge.

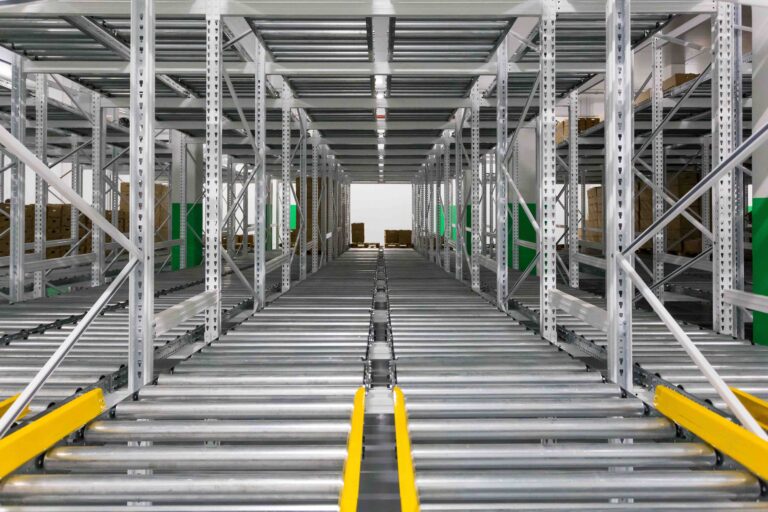

The retention or dispossession is characterised by the handing over of the material asset to the creditor as security for a loan. This may be stock. The pledge is entrusted to a trusted third party.

There is no transfer of ownership; the company temporarily transfers possession of the asset until the debt is repaid. This arrangement serves as a guarantee in the event that the debtor fails to meet its obligations. A pledge with delivery provides additional security in the event of default.

Please note that there are two different terms for pledges: pledge “with” or “without” dispossession.

These two guarantees should not be confused.

In both cases :

On the other hand, in the case of a pledge with dispossession :

In the case of a non-possessory pledge :

In the case of a pledge with dispossession, either :

There are many advantages to a pledge with delivery for creditors and debtors alike:

This reduces the risk for the creditor.

However, since every situation is different, it is important to call on a consultancy firm such as Chetwode, as part of our partnership with ACTENE, to study the possibility of obtaining financing backed by a pledge with delivery in your business.

If you want to take out a loan backed by a pledge with delivery, here are the various steps you need to take:

A pledge with delivery is relatively simple to set up and flexible to manage on a day-to-day basis. It also makes it easier to access new lines of finance.

If you would like to find out more about this type of guarantee and financing, we will be happy to discuss it with you.